Designing a better product by facilitating a human-centric co-creation design process

How I conducted quantitative and qualtiative user research and leveraged the insights to foster a human-centric design with various stakeholders, enabling us to make informed decisions for designing a better product.

![]()

WHAT I DID

• Planned and conducted user research

• Facilitated workshops across different teams

• Creating UX/UI design for iOS/Android app

SUMMARY

The ABN Amro's mobile banking app showed at least 5 to 20% lower conversion rate when compared to that of the internet banking for the same product offering. The project to improve this was on-hold despite the targets, strategies and designs that had been created because it was difficult to reach an agreement between multiple stakeholders.

I made a breakthrough for the project by identifying and presenting users' pain points and facilitating workshops to co-create designs with stakeholders.

Background

We can deal with a lot of matters digitally. The same goes for the banks. We want to deal with our bank matters whenever, wherever we are. ABN Amro, the second biggest Dutch bank, had enabled daily banking on digital platforms and was challenged to offer more regardless of time and location like any other modern banks.

To meet the versatile needs of the digital customers and also to save the cost of running services physically in bank branches, we introduced a digital shop - digitized financial product acquiring processes

as one of those initiatives.

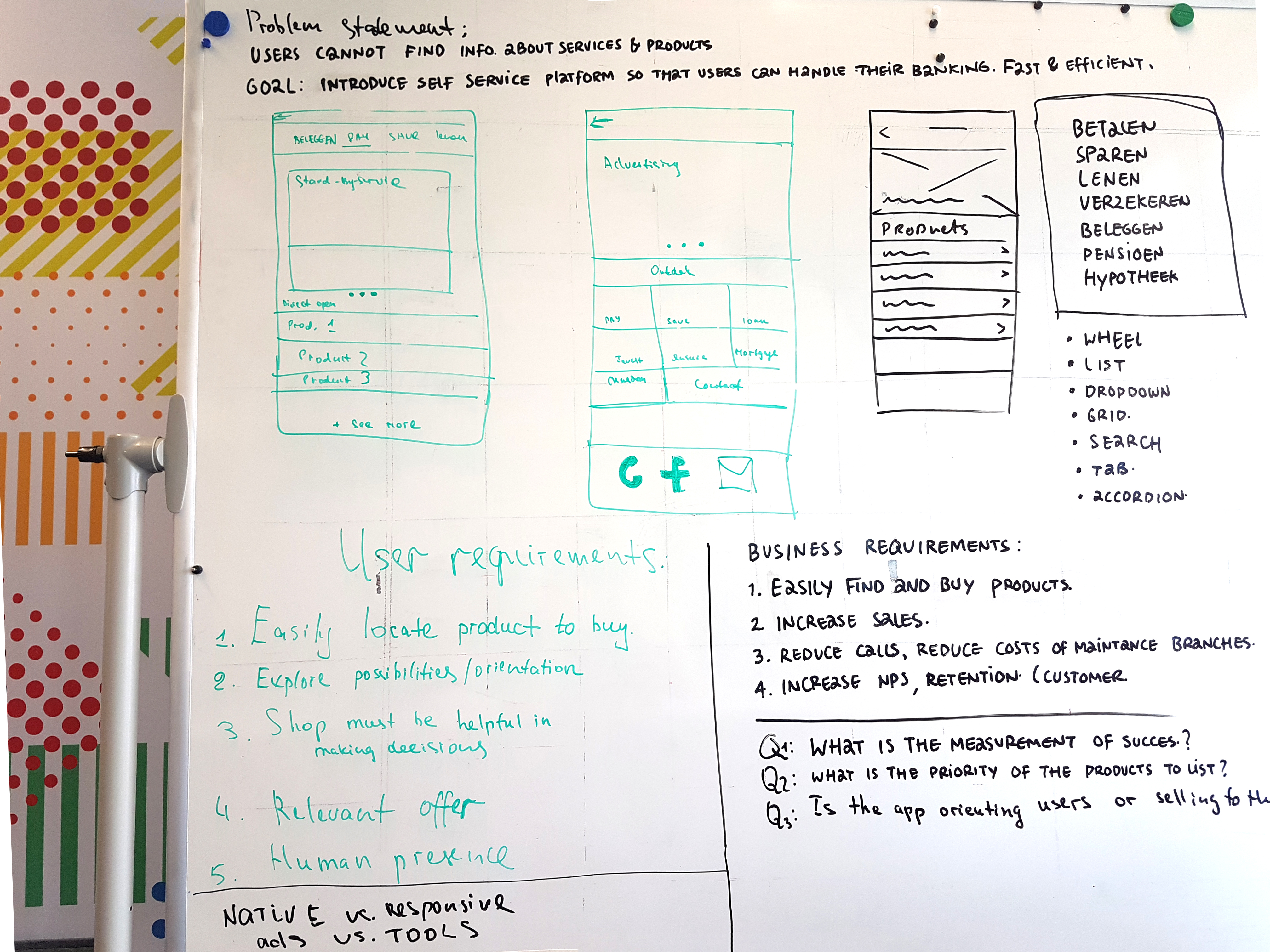

▲ I was given a big brief at the beginning of the project.

Challenges

1

2

Understanding the users with quantiative & qualitative data

I quickly grasped that we did not have answers for the most important questions.

• Whom are our target users?

• Who are the target users? Who are mostly interested?

• What products are they interested?

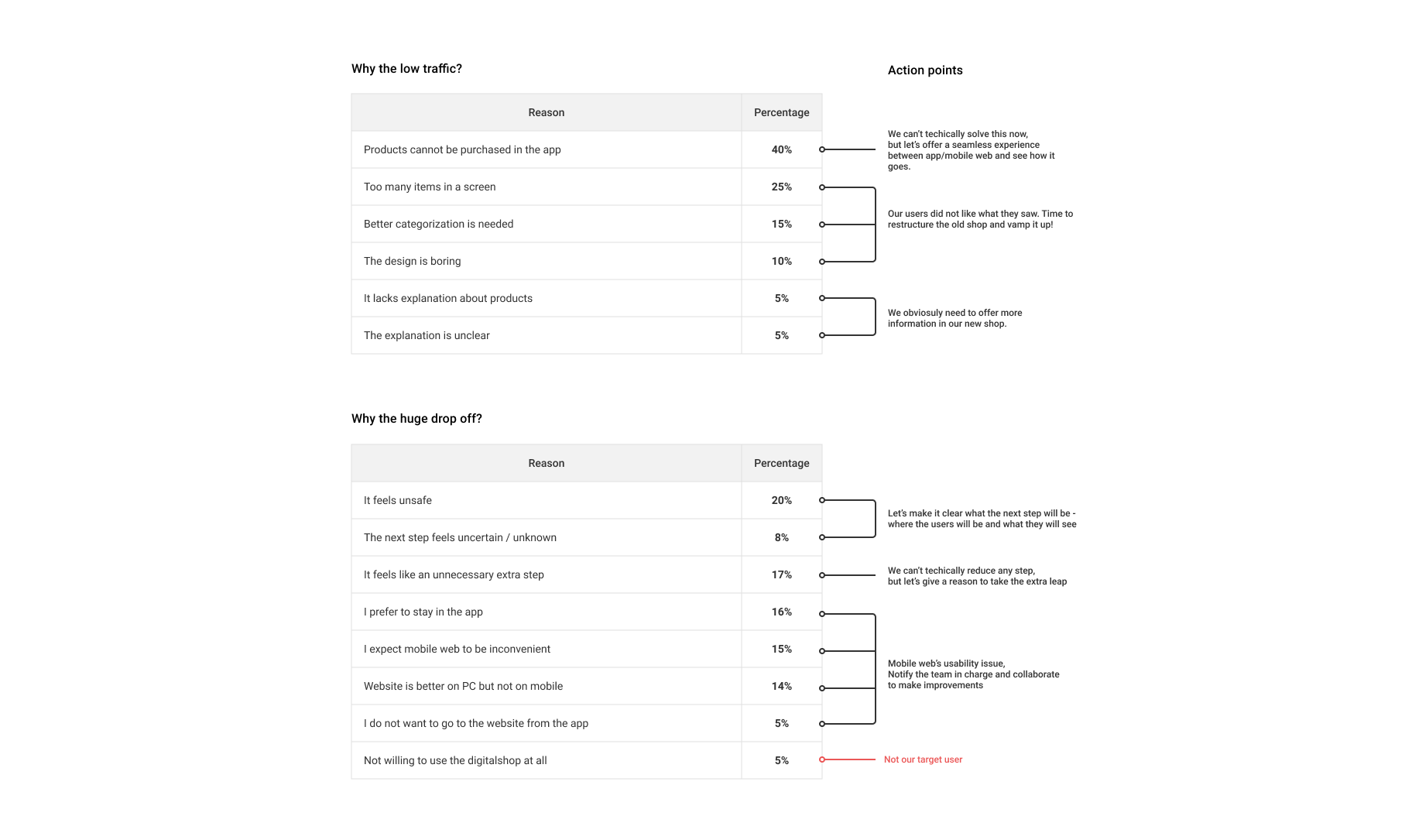

• What are the causes of the low traffic and the huge drop-off rate?

I ran quantitative research with 1035 users.

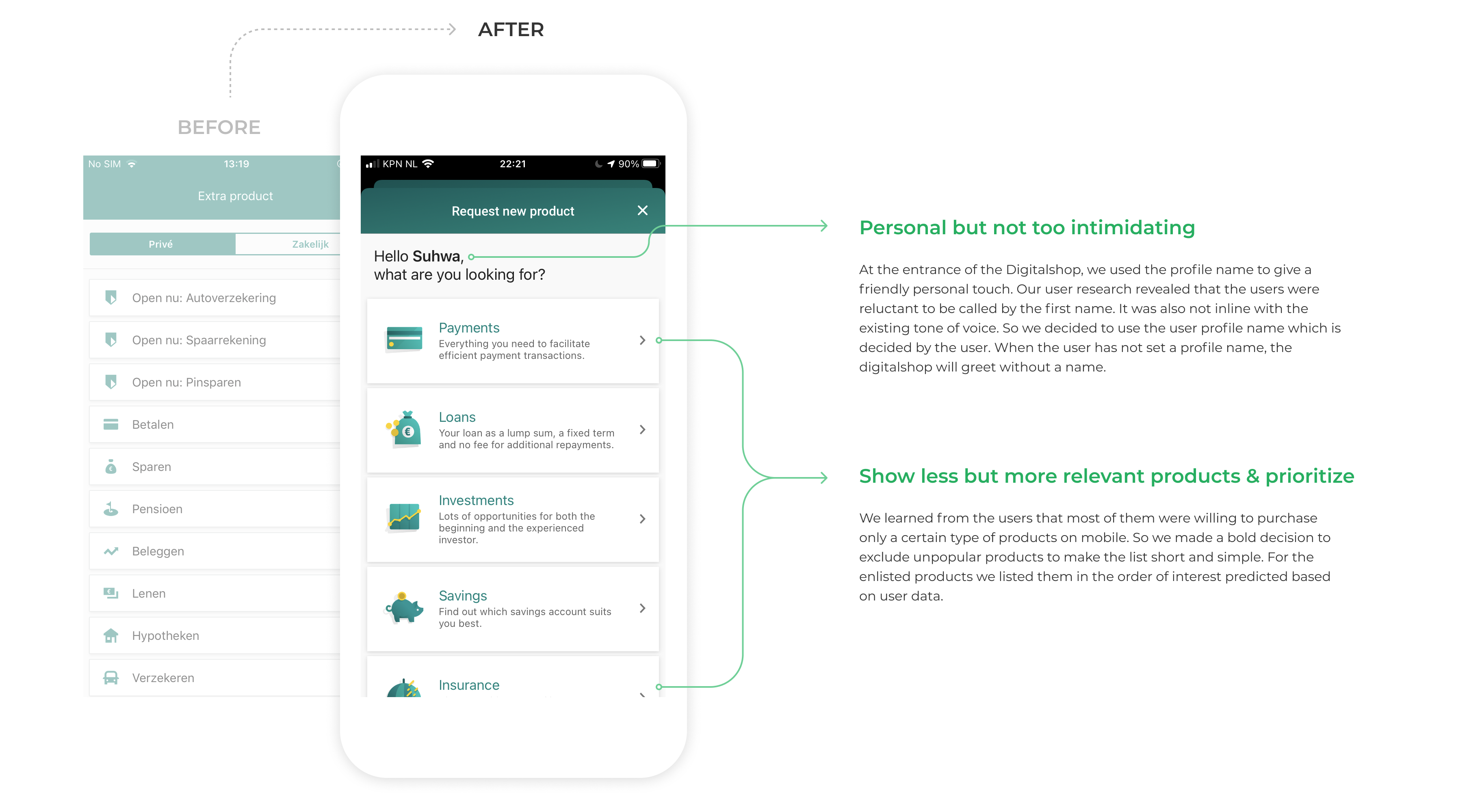

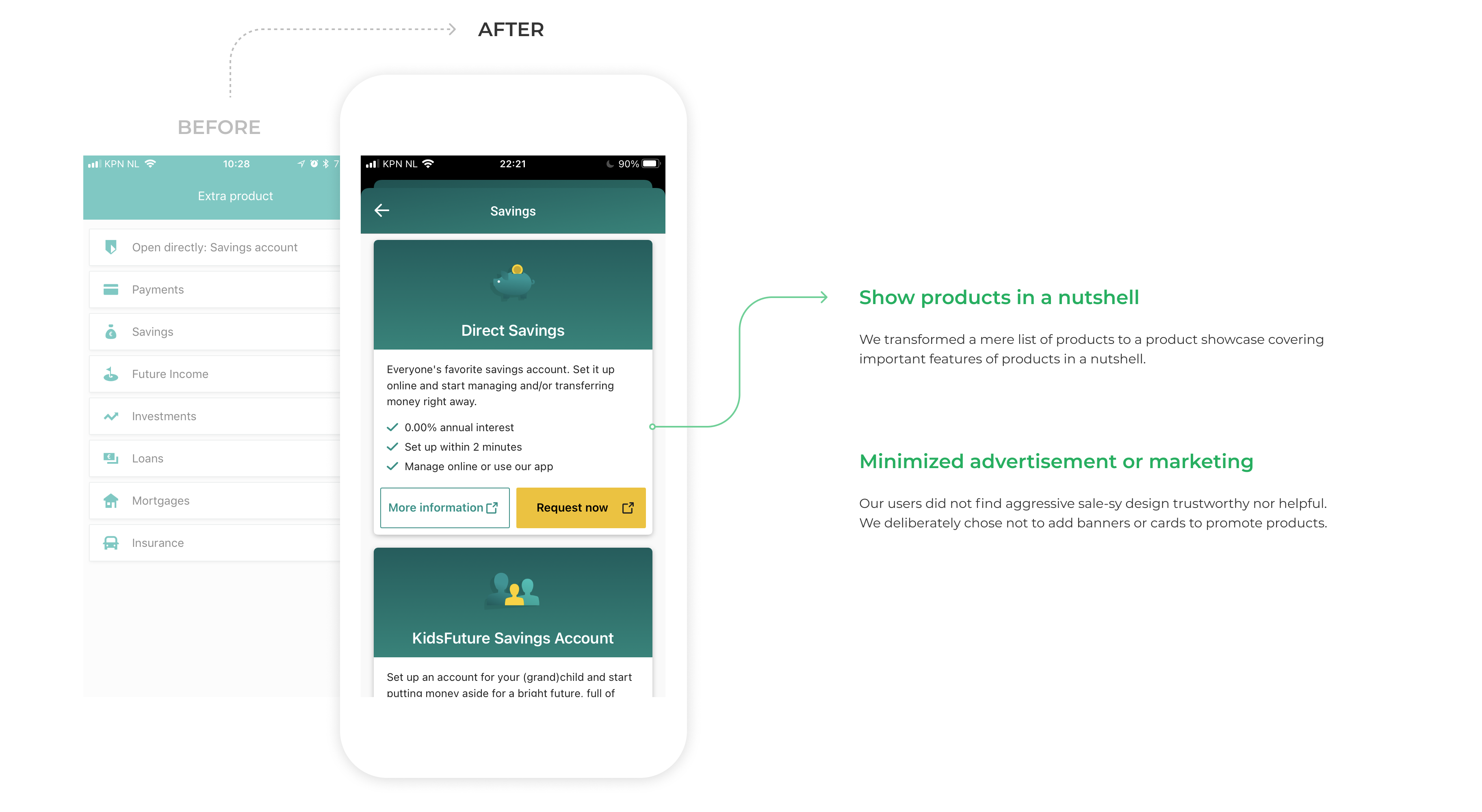

It turned out that younger users were more interested in acquiring payment account, overdraft, savings account, or simple insurance products. The senior customers were less willing and in general, the users were reluctant to acquire more complex financial products such as mortgages or loans. Based on this, we came up with a set of products that needed our attention in our MVP version of the Digitalshop. The initial Digitalshop was optimized to present simple products and to present essential information around them.

▲ Survey flow to find highly potential users and their needs

▲ Our research revealed that the younger the users were, the more they were willing to acquire financial products fully digitally. Based on this, we decided on the target user.

▲ We also did a research on the preceding service, which was not gaining enough traction. We got our important insights and action points from this.

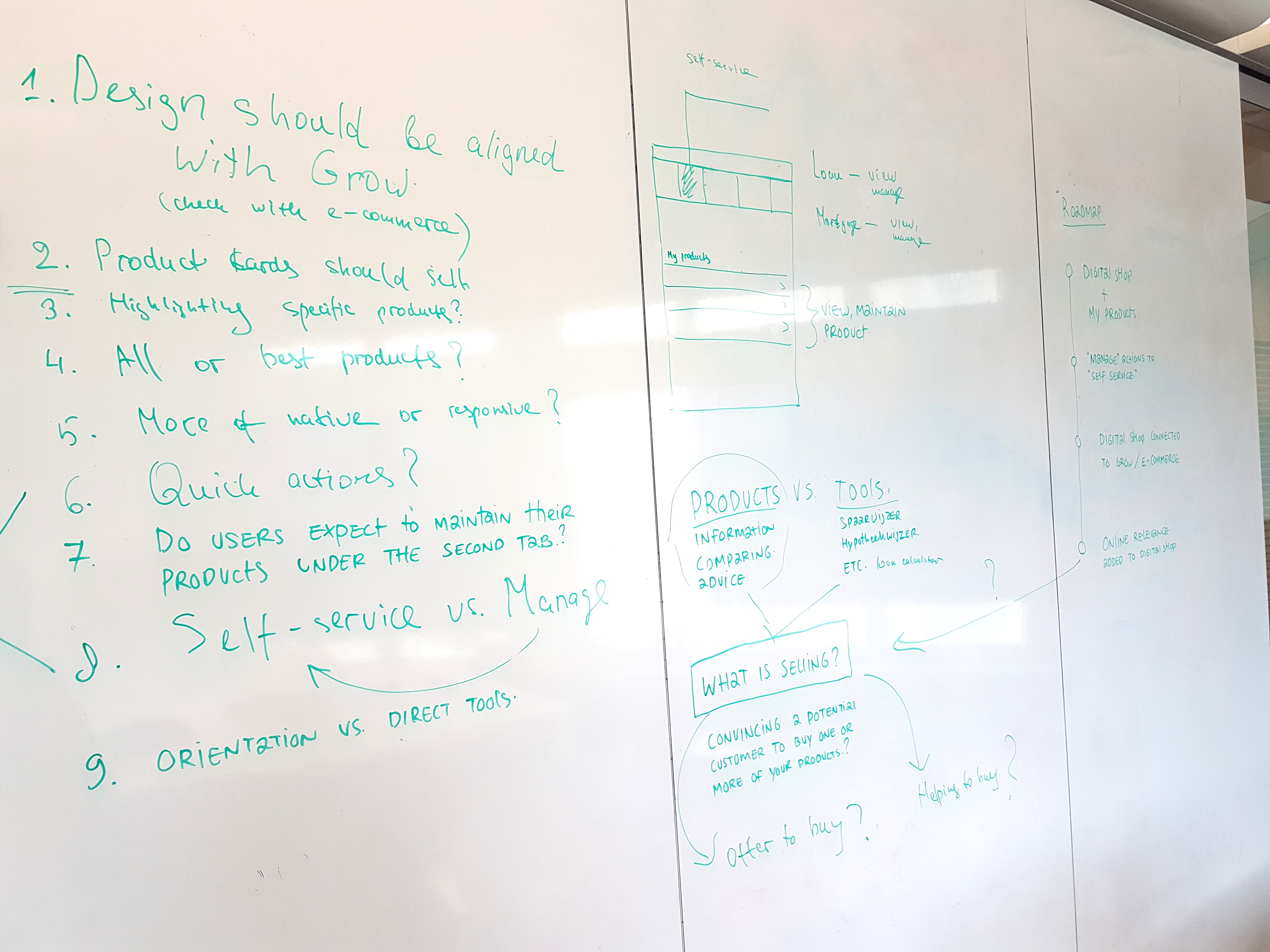

Facilitating a workshop to co-design a solution

This project had numerous enthusiastic stakeholders outside of the development team, but consensus was difficult to reach. As a result, the project was impeded for 1.5 years. I turned this complexity as an opportunity for a great collaboration.

To achieve that, I facilitated a concept ideation session with all stakeholders aiming to create a concept that everyone can agree with and meet the unmet user needs.

Concepts were evaluated against the agreed criteria.

Our concept was born following these precious steps:

• I presented user insights obtained from user research.

• We came up with important criteria for the design.

• We agreed on the priority of the criteria.

• We sketched all of our ideas on paper, using Crazy 8's method.

• We evaluated the ideas based on the agreed criteria.

• We combined selected ideas to make it into one concept.

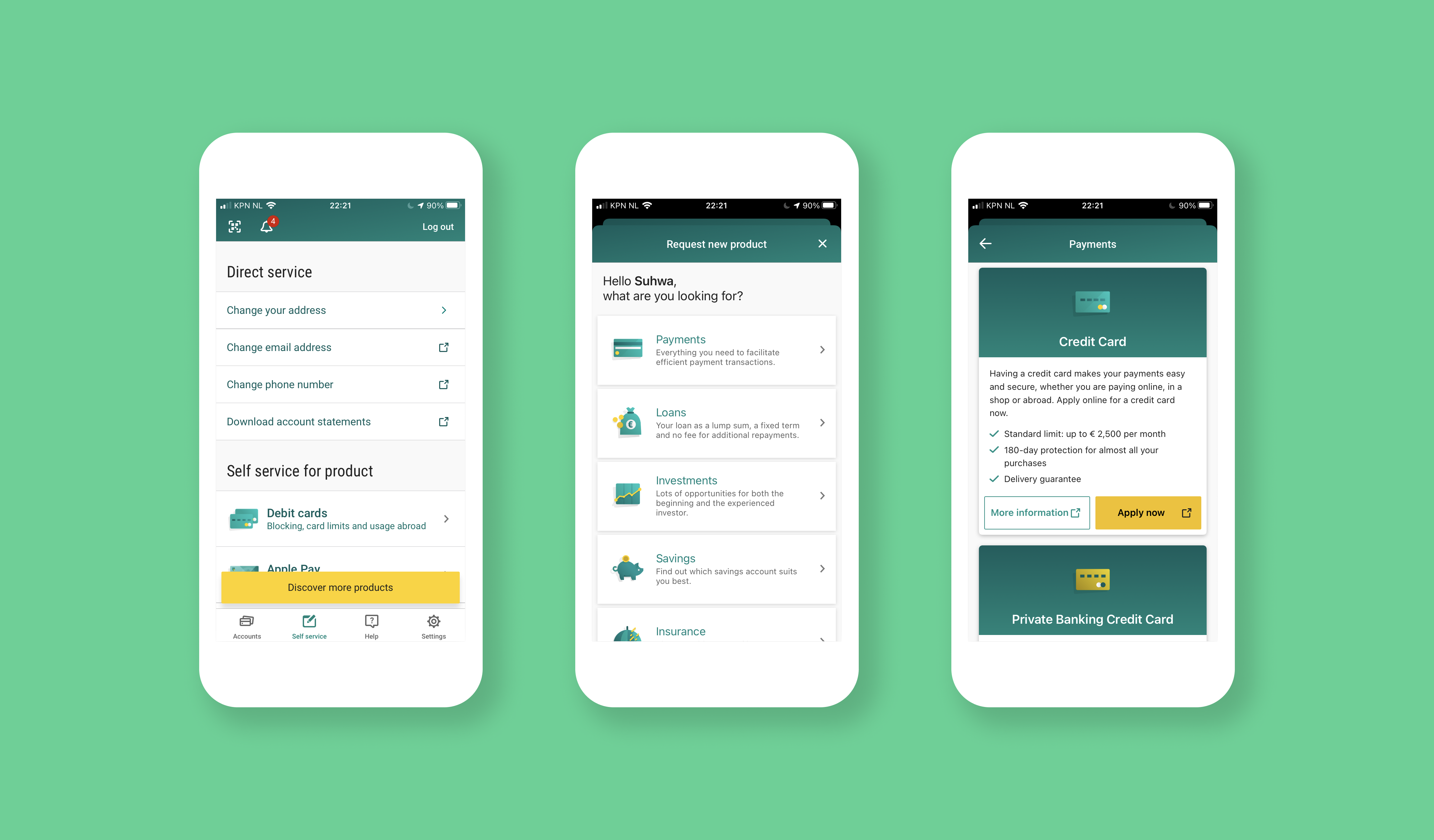

Design

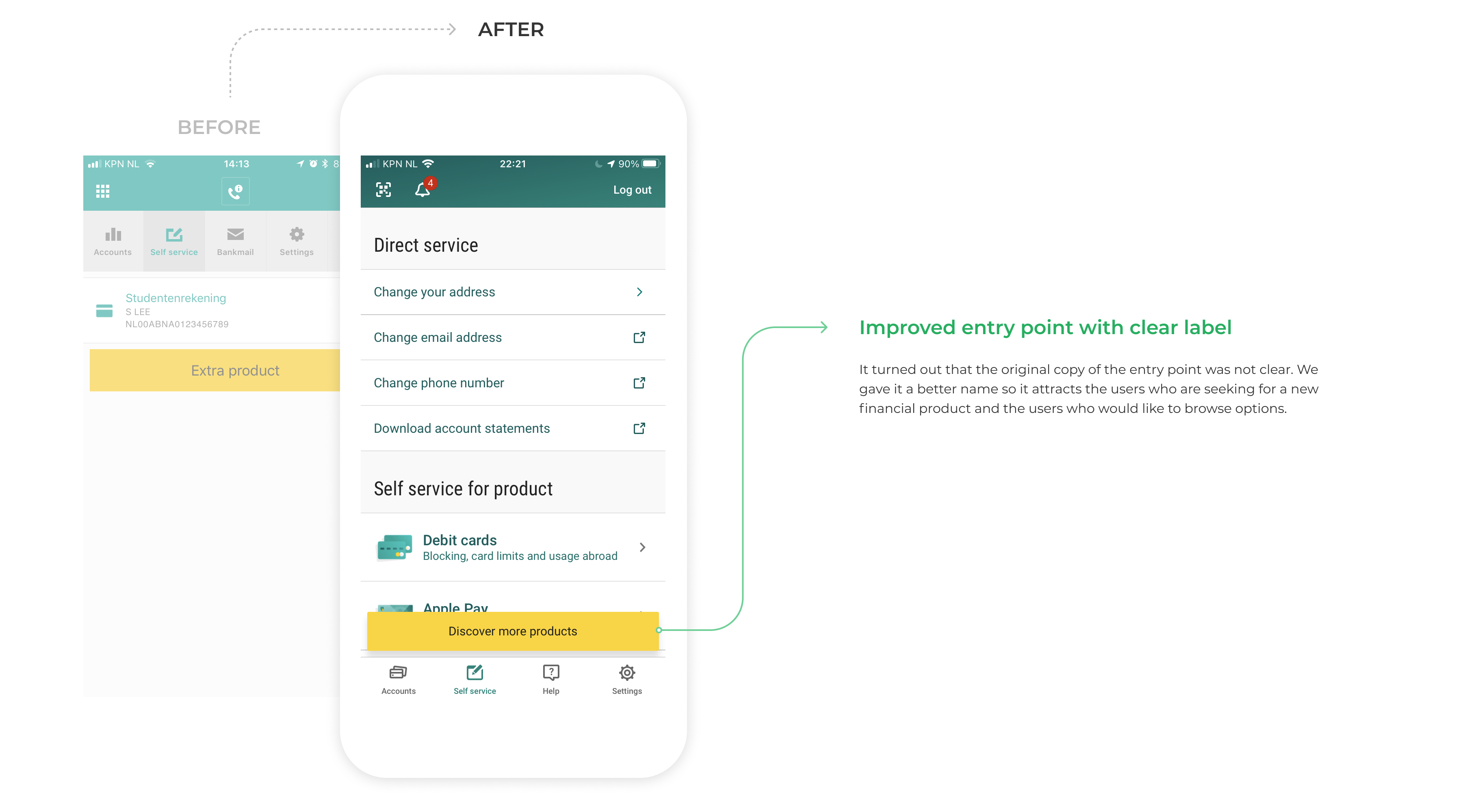

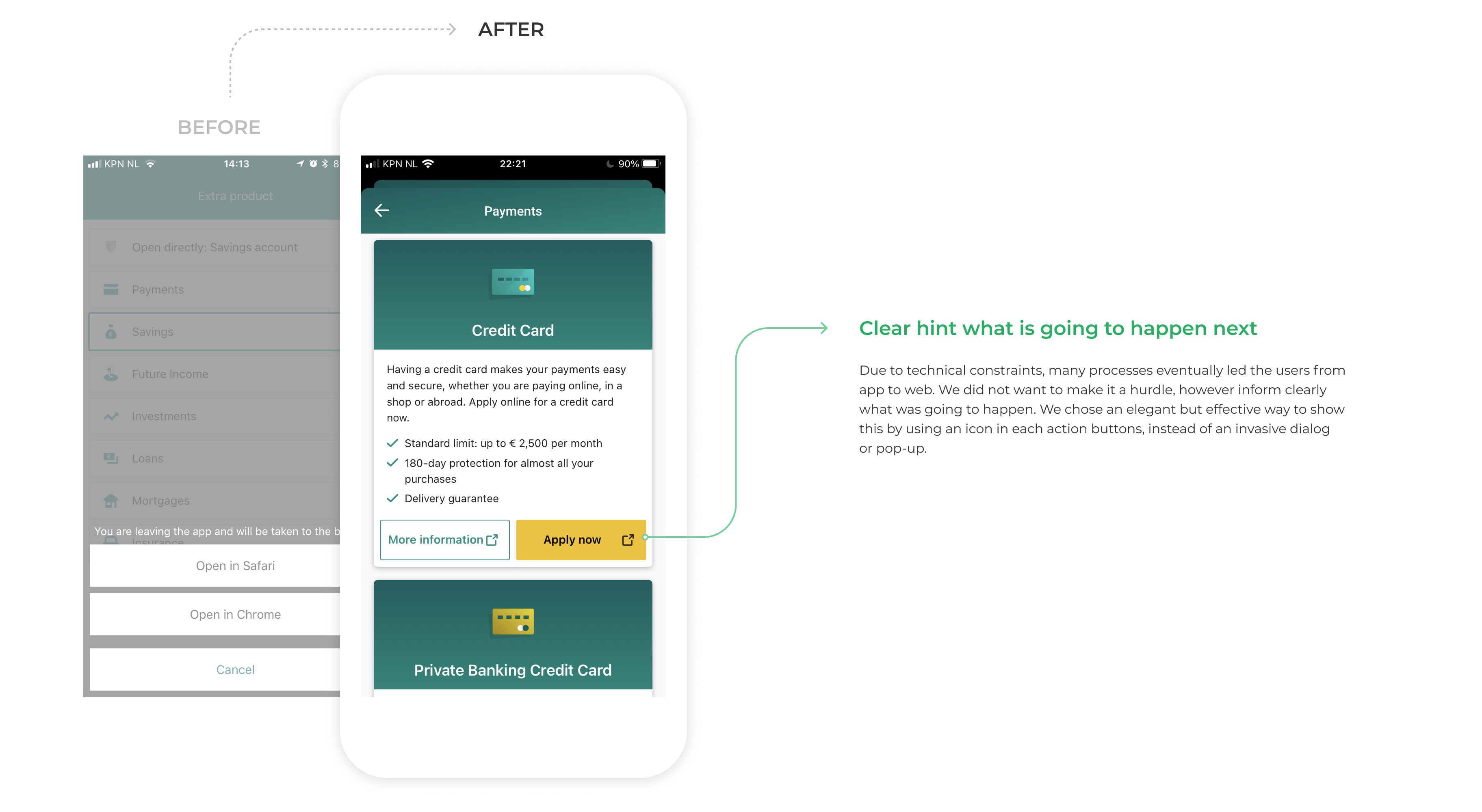

Based on the outcome of the workshops, I designed the feature with much clear strategies and tactics.

Results

In early 2020 the Digitalshop was launched on ABN Amro's mobile banking app. Since then, it has been giving the flexibility to open accounts and apply for insurances in the palm of the users' hand.